Redesigning a Global Amazon Retail Media Operating Model

From Tactical Optimisation to Institutionalised Growth Architecture

Executive Abstract

In a global Amazon environment spanning multiple regions, a hybrid operating structure delivered performance but lacked structural integration. Media execution was active and investment levels were increasing, yet allocation logic, governance discipline, and retail readiness were not consistently aligned across geographies and teams. The transformation was facilitated to redesign Amazon from a performance execution environment into a governed retail media operating system — integrating retail fundamentals, hybrid portfolio segmentation, governance architecture, and automation principles into one coherent framework. Rather than optimising campaigns further, the intervention addressed the architecture shaping decision-making at scale. All details are anonymised and intentionally abstracted. No proprietary data, client materials, or internal frameworks are disclosed.

1. Organisational Context: Where Complexity Begins to Drift

Hybrid global Amazon environments rarely fail because of tactical inefficiency. They become unstable because architecture does not evolve at the same pace as scale.Across regions, Vendor and Seller portfolios operated in parallel. Local teams interpreted performance indicators independently. Investment allocation responded to short-term signals, while retail fundamentals were reviewed in parallel rather than embedded into a unified investment logic.Performance remained acceptable.

Scalability was fragile.As complexity increased, the system required continuous manual coordination to prevent internal friction.

2. Architectural Diagnosis: What Was Structurally Limiting Scale

The diagnostic phase identified four systemic pressure points.

Retail–Media Misalignment

Media investment decisions were sometimes made without a consistent mechanism to gate scaling based on retail health. When retail conditions fluctuated, media scaling could amplify volatility, triggering reactive corrections rather than preventative discipline. Retail signals existed — but they did not govern allocation decisions.Scalability was fragile.As complexity increased, the system required continuous manual coordination to prevent internal friction.

Hybrid Portfolio Overlap

Hybrid models often drift into overlap when strategic roles are not structurally segmented. Defensive activity, competitive conquest, and category expansion can converge into similar query spaces, increasing internal inefficiency and diluting investment purpose.The hybrid model existed operationally, not architecturally.

Governance Variability

Before intervention, allocation logic varied across teams and regions. Similar performance patterns could trigger different decisions depending on local interpretation. After implementation, decision frameworks were harmonised. Execution retained local nuance, but investment discussions followed a shared architectural logic. The shift was from interpretation-based to framework-based governance.

Operational Dependency

Scaling activity required proportional increases in coordination effort. Reporting logic and performance management depended heavily on manual oversight, limiting repeatability. The operating model was expert-driven rather than system-driven.

3. Redesigning the Operating Architecture

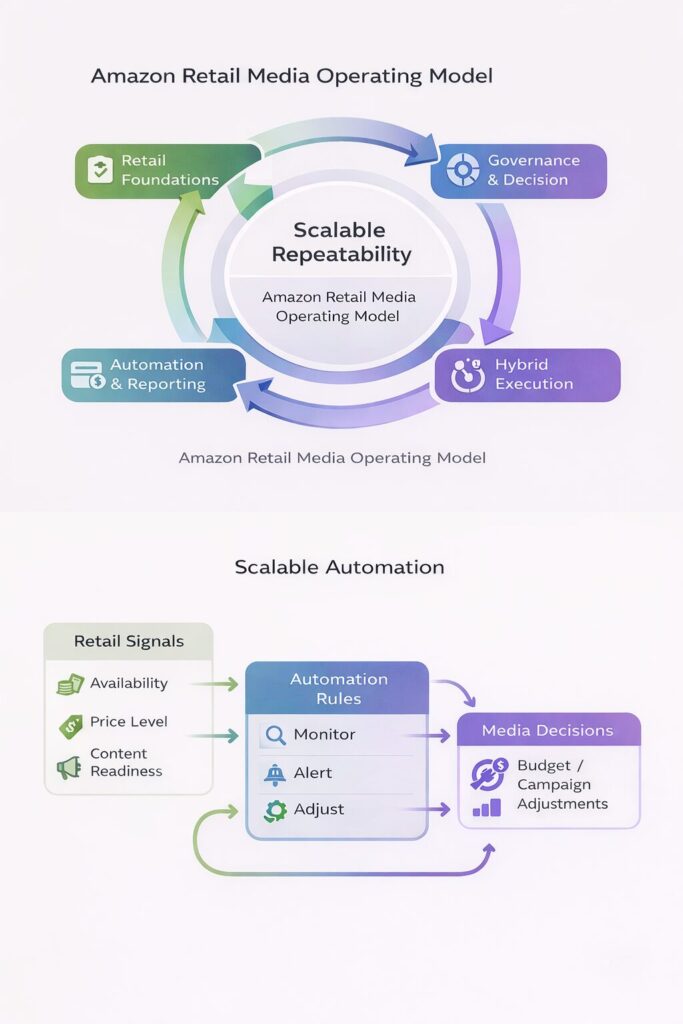

The transformation introduced structural alignment across four integrated layers.

Retail Foundations as Investment Gatekeepers

Retail readiness became a prerequisite for scale. Investment expansion was made conditional upon defined retail health criteria. When structural risk signals emerged, scaling was paused or reallocated — preventing media from compensating for underlying retail gaps. This reduced volatility and improved capital efficiency without increasing investment intensity. Media stopped compensating for weaknesses and started amplifying readiness.

Governance Before Budget Expansion

A harmonised performance hierarchy aligned interpretation across teams. Allocation logic became structured around consistent decision principles rather than local heuristics. Before: similar data triggered different decisions.

After: similar data triggered aligned allocation responses. Performance cadences were structured around architectural consistency, not tactical uniformity. Governance preceded allocation.

Structural Segmentation of the Hybrid Model

Rather than organising execution around account ownership, the redesign segmented portfolios by strategic function. This clarified budget purpose, reduced internal overlap, and enabled complementary execution within the hybrid structure. Hybrid complexity was not reduced by simplification. It was reduced by structural clarity. Automation for Repeatability Retail and performance signals were translated into structured monitoring and adjustment logic to reduce operational volatility. Automation did not replace judgment. It disciplined it — enabling consistent oversight at scale while reducing manual firefighting.

4. Implementation Dynamics

Because the operating model spanned multiple regions, the redesign required cross-team facilitation rather than centralised imposition. Alignment sessions surfaced structural friction and converged on shared governance principles. The rollout was phased to preserve local nuance while establishing architectural consistency. The emphasis was coherence — not uniformity. The role was to orchestrate alignment across distributed teams and stakeholders.

5. Structural Outcomes

The transformation delivered measurable structural clarity:

Reduced internal overlap in hybrid execution

Stabilised allocation decisions across teams

Lower operational dependency on manual intervention

Improved alignment between retail readiness and media scaling

Amazon evolved from reactive performance management into governed retail media infrastructure. The system became scalable without multiplying complexity.

Operating Model Evolution

Hybrid strategies operated in parallel without structural segmentation. Media allocation responded primarily to short-term performance metrics. Retail signals were reviewed but not embedded in investment logic. Decision ownership varied across teams. Reporting required heavy manual coordination.

Similar data triggered different allocation decisions across regions. The system functioned, but scalability depended on human intervention.

After: Governed Growth Architecture

Hybrid execution segmented by strategic role. Investment scaling conditional upon retail readiness criteria. Unified performance hierarchy guiding allocation logic. Harmonised decision frameworks across teams.

Automation principles embedded to reduce operational volatility. Allocation decisions disciplined by architecture rather than interpretation. The system became scalable without multiplying complexity. Similar data triggered different allocation decisions across regions. The system functioned, but scalability depended on human intervention.

Strategic Implication

Retail media maturity is not defined by spend sophistication or bidding precision. It is defined by operating architecture. Hybrid environments without segmentation drift into inefficiency. Media without retail anchoring amplifies volatility.

Automation without governance multiplies noise. When these layers align, Amazon transitions from tactical execution to institutionalised growth infrastructure. Operating design precedes performance. Automation principles embedded to reduce operational volatility. Allocation decisions disciplined by architecture rather than interpretation. The system became scalable without multiplying complexity. Similar data triggered different allocation decisions across regions. The system functioned, but scalability depended on human intervention.

Role in the Transformation

Cross-team facilitation of operating model redesign, governance alignment, hybrid portfolio segmentation, and automation framework integration within a global Amazon environment.